DeFi and traditional finance can be considered similar, but there are several differences, and it is important to understand the exact meaning of each term.

At its simplest, decentralized finance is an open financial sector that runs on software built on public Blockchains. This includes building financial products and services on Blockchain to facilitate or enhance the development of open financial systems.

DeFi seeks to revolutionize the financial industry by serving as an alternative to centrally controlled institutions such as banks that have historically acted as financial intermediaries.

DeFi uses several progressive and flexible tools to put users in control. The fact that the new trend provides additional functionality while reducing operational risk makes it a perfect replacement for the current financial system.

DeFi is a financial system focused on creating decentralized applications for Blockchain technology. DeFi allows users to send, receive and even lend money without the help of third parties.

On the other hand, traditional finance is centralized finance that manages assets on behalf of users. Third parties manage these transactions, and they also make use of manual methods to organize finances; lending, borrowing and saving money.

What are the differences between DeFi and traditional finance? This article will compare the differences between the two and also talk about the advantages and disadvantages of each of these finances.

But before we see the differences, let’s briefly see what DeFi means and how it works.

What Is DeFi And How Does It Work

The digital world allows you to do several things, including secured and decentralized transactions, and it is a new financial technology that protests against the current centralized banking system.

DeFi eliminates the fees charged by banks and other financial institutions using a fast and secure technology.

Here are some of the things that decentralized finance does:

- Peer-to-peer (P2P) lending and borrowing: this is gaining popularity in the DeFi space. Decentralized financial systems have been well received by many because they do not require escrows or intermediaries. Some popular DeFi platforms are Compound and PoolTogether. These platforms have autonomous protocols to borrow and lend assets.

- Derivative and synthetic assets: smart contracts allow the creation of tokenized derivatives, making it one of the most unique use cases for DeFi. Tokenization of derivatives means determining the value of a contract based on an underlying financial asset or set of assets. These underlying financial assets behave like traditional securities. It can consist of bonds, fiat currencies, commodities, market indices, interest rates or stock prices.

- Margin trading: like traditional trading platforms, DeFi platforms offer margin trading as an opportunity to raise funds from decentralized funding platforms (e.g. Aave, Compound, Venus) that traders can use as leverage to make money. This trading method is fully covered.

- Lending: when you lend cryptocurrency, you get interest and rewards every minute instead of once a month. You can get an instant loan without paperwork, including very short “flash loans” not offered by traditional financial institutions.

- Saving for the future: you can put some of your cryptos in an alternative savings account and get a better interest rate than you would normally get from a bank. You can also buy derivatives, where you can place a long or short bet on a particular asset. Think of it as the crypto version of stock options or futures.

- Trading: you can trade certain crypto assets side by side. It’s like buying and selling stocks without using a brokerage service.

The Difference Between DeFi And Traditional Finance?

There are several differences between DeFi and Traditional Finance, and we will consider some of the major differences.

- Management

DeFi is decentralized. In essence, it negates central management, no single institution or individual controls operations. On the contrary, smart contracts manage the engagements allowing little to no human interventions.

Traditional financial systems, on the other hand, have centralized control. The Central Bank is in charge of overseeing overall financial activities. The organization is hierarchical, with different people having different levels of ability to intervene in financial transactions.

- Platform

DeFi, as a technological invention, operates on a Blockchain platform. In turn, Blockchains are hosted on the internet. Accordingly, DeFi doesn’t require a physical premise to operate. Alternately, traditional financial systems are brick-and-mortar models. They require physical space to function.

- Transparency

DeFi runs on Ethereum and other public Blockchains. Consequently, it is transparent. All transactions are publicly verifiable. However, transactions are pseudonymous. This function aids in concealing the true identities of the parties involved. Traditional financial systems, on the other hand, are private. You deal with your banker, agent, or broker individually. Furthermore, your true identity is revealed.

- Control

In the DeFi system, you are in full control of your funds. The only prerequisites are an internet connection and smart contracts. You decide when to transact, with whom, and in what quantities. That is not true in traditional financial systems. Here, you hand over control of your funds to several agents. The first is the central bank, which regulates the industry. Second, your bank is the custodian of your funds. The third component is the agent/agency that works for you.

- Flexibility

In DeFi systems, users have a flexible experience. For example, one can change the interfaces of their dApps at any time. They can either make them themselves or get them from third parties. This is not the case in traditional financial systems. The user experience is established from the start. The central authority develops customer policy. All customers receive a one-size-fits-all service.

- Interoperability

DeFi systems enable function interoperability. New products and services are emerging as the crypto finance sector evolves. These can be built on top of existing dApps to provide additional functionality. Traditional finance, on the other hand, does not permit interoperability. Each player has a differentiated product. One cannot build on or alter this without permission from the owners.

DeFi vs traditional finance: which is best?

Both financial systems have great potential. The main difference is that crypto-savvy users can invest through DeFi platforms, while crypto beginners can gain more experience by choosing a centralized financial platform. DeFi operates as an autonomous entity that gives its users leverage and asset ownership.

Decentralized finance is emerging as an alternative to traditional finance as it can eliminate the current financial red tape that currently burdens the financial system.

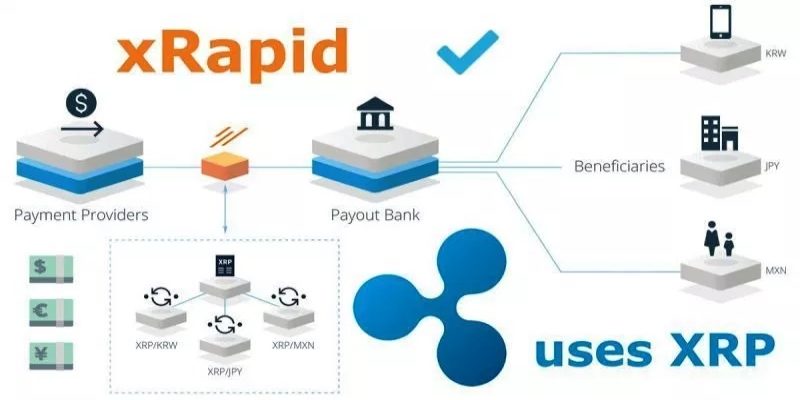

Digital ledger technologies such as Ripple’s XRapid allow people to take full control of their wealth and personal financial data while transacting in the global financial industry.

For the first time in history, a decentralized financial system is being developed on a massive scale. The bank has many rules to protect your rights and assets in getting money easily. DeFi uses secure Blockchain technology. Data on the Blockchain is tokenized and immutable.

While DeFi makes it easy for owners to access, the traditional could take more time, but it also provides reliable services that can come in handy in the physical world, where there might be no access to a virtual environment.

It is hard to decide the best finance, but the advancement is toward a virtual society due to evolutions worldwide. The improvement in the digital world would lead to an improvement in decentralized finance, thereby making it more reliable as the world evolves.

Advantages and disadvantages of DeFi

Decentralized funding has several advantages and disadvantages.

Advantages

- Transactions are carried out in real-time: the Blockchain network ensures that transactions are completed and updated promptly.

- Asset management: one of the major effects of DeFi is that users now have more control over their assets. However, many popular DeFi initiatives provide users with asset management tools such as buying, selling and transferring digital assets. As a result, customers may be interested in digital assets. And unlike traditional banks, DeFi allows its customers to keep their sensitive data private.

- Insurance: insurance protects investors from hacking and other fraudulent activities. Insurance plays a very important role in decentralized finance and is much less common in DeFi.

- Permissionless: anyone with a cryptocurrency wallet and internet connection can access DeFi services. Users can trade and move assets anytime, anywhere. Borderless payments are one of the key features of DeFi.

- Quick and reliable access: before DeFi, if you needed a loan, you had to go to the bank and waste a lot of time. With DeFi, you can receive a loan with one click, even in the middle of the night. You can access the market whenever and anywhere you choose as long as you have an internet connection.

- Well-managed assets: we have already mentioned that financial crises are caused by mismanagement by central banks and third-party intermediaries. However, the use of smart contracts removes human error from routine processes unless the term itself is misspelt.

- A healthy system: the pandemic in 2019 has shown that the traditional financial system is extremely vulnerable to global shocks. This is because centralized financial systems rely on direct communication between individuals.

Disadvantages

- Low interaction: there are different types of Blockchains, such as Bitcoin, Ethereum and Binance Smart Chain, each with its DeFi ecosystem and community. Interoperability allows DeFi platforms, tools, dApps and smart contracts on different Blockchains to communicate with each other. Until this is easy, many projects will operate in silos.

- Your responsibility: assuming DeFi is free of risks and problems, you are still not responsible for mistakes. DeFi shifts responsibility from intermediaries to users. No one will be held accountable if you accidentally lose money, so creating tools to prevent human error and blunders in the DeFi space is essential.

- Unpredictable: if the Blockchain hosting a DeFi project is unstable, the project automatically inherits this instability from the host Blockchain. The Ethereum Blockchain is still going through many changes. For example, mistakes during the transition from PoW to the new Eth 2.0 PoS system could introduce new risks to DeFi projects. The rates fluctuate

- Technological problems: since DeFi is a functional software, there is always a possibility for bugs and even loopholes that could cause loss to a user.

Advantages and disadvantages of traditional finance

Advantages

- It creates job opportunities: since it is an organized body or institution, people are needed to serve as the third party in the transaction process, thereby creating a space for employment.

- Improves national economy: the income generated can be used to fund government plans.

Disadvantages

- Complicated process: The process involved in getting loans from financial institutions can be expensive and time-consuming.

- Collateral schemes: Financial institutions are governed by strict government regulations, which require them to grant loans only against certain collateral. As a result, eligible organizations sometimes cannot obtain financial assistance because of a lack of security.

- Poor customer service: Traditional finance finds it hard to satisfy customers’ needs and does not enable people to voice their concerns.

Examples of DeFi

There are several examples of DeFi, but just to mention a few of them, here are the most popular ones;

- Chainlink: this is a decentralized service that connects data from the physical world with smart contracts through Oracle technology; it enables DeFi to function properly and avoid possible glitches

- Polygon: Polygon (MATIC) is one of the largest and fastest-growing Ethereum Layer 2 scaling solutions and decentralized application ecosystems. It has features like interoperability, scalability and security. Essentially, Polygon adds a few lanes to a heavily trafficked Ethereum Layer 1 highway. Currently, most DeFi projects are hosted on the Ethereum Blockchain. So less congestion on Ethereum means faster speeds and more benefits for the DeFi ecosystem.

- Terra Luna: It is a state-of-the-art smart contract platform that combines the concepts of decentralized finance and stablecoin. The platform supports stablecoins that offer instant payments, low fees and seamless cross-border transactions. Luna is an unstable anchor that keeps its stablecoin sibling, Terra, in balance. With DeFi growing in popularity due to the considerable attention stablecoins are receiving from both consumers and governments, LUNA is something to watch out for.

- Cardano: Cardano (ADA), one of the world’s largest Blockchain projects, has earned the nickname “Green Blockchain” thanks to its impressive power usage reports and verification-of-stake protocol.

Conclusion

Traditional finance still serves many people today and is a major part of our lives, while decentralized finance is something to look forward to.

We can agree that decentralized finance is the future, while traditional finance is the fading present.

Meanwhile, decentralized finance is a new technological program that is still a work in progress; though we have also experienced how swift it could be, there is much more to look forward to in the future.

The digital world is taking over, and the advancement would benefit everyone.

See you soon,

Scaling Parrots