Blockchain may appear to be a complex technology with little relevance to your business. However, innovative business leaders must understand the technology’s underlying principles because it has the potential to dramatically improve business processes and make infrastructure more reliable and less reliant on third parties.

To prepare for the future, your company must quickly become acquainted with Blockchain concepts and seek ways to incorporate the technology into its operations.

However, many businesses are aware of Blockchain but struggle to calculate the likely Return on Investment (ROI) of a Blockchain application, which is required for corporate funding approval.

In contrast to a typical IT project in which your company controls all aspects of the system and its use, Blockchain applications are used to share information with business partners or clients and, thus, are not completely under your control.

Blockchain has enormous potential benefits but introduces far more complications and uncertainty into ROI calculations.

There are dozens of factors or criteria to consider when taking into consideration whether or not to pursue a Blockchain application, as well as determining which potential applications are the most promising and offer the best ROI.

92% of the groups believe that the difficulty in determining ROI is a barrier to Blockchain adoption. And this has discouraged many businesses from adopting Blockchain technology which shouldn’t be.

But is there any way Blockchain ROI can be calculated? If YES is the answer, how can it be calculated? That’s what this article will focus on; it will show different ways to calculate ROI in Blockchain technology that many people seem to ignore.

But before we see how this Blockchain ROI can be calculated, let’s briefly see what ROI and Blockchain technology mean.

What is ROI

ROI, which is usually expressed as a percentage, allows you to compare investments based on the amount invested and the amount gained or lost. Calculating the return on investment (ROI) is a statistical tool that assists the investor in determining the orientation of his investments.

The ROI calculation corresponds to the following ratio: ROI (%) = (gain of investment minus cost of investment) / cost of investment. If the concept of temporality is not used in calculating the ROI, it is calculated over a set period of time, usually one year.

The ROI is a useful decision-making indicator. Indeed, the ROI result enables the investor to choose the investment project that promises to be the most profitable in relation to the initial investment. The return on investment is calculated in two scenarios:

- 🏢 For a company: it makes it possible to define the most profitable project or products.

- 💵 For an investor: associated with other indicators such as risk, it makes it possible to define the most profitable investment project or product.

What is Blockchain technology

A Blockchain is a database that records all transactions between its users since its inception. This database is secure and distributed: it is shared by its many users without middlemen, allowing everyone to verify the chain’s validity.

A Blockchain is thus analogous to a public, anonymous, and tamper-proof ledger. You can compare Blockchain to an enormous notebook, which everyone may read freely and free of charge, on which everyone can write but is impossible to erase and indestructible.

Companies rely on the information in the ledger. The faster these circulate, the more precise they are. Because it provides immediate, shareable, and entirely transparent information that is recorded in an immutable ledger that only authorized members of the network can access, Blockchain is an excellent fit for making information available.

A Blockchain network, in particular, allows for tracking orders, payments, accounts, and production. Because members have the same perspective on the situation, everyone can see all the nuances of a transaction from beginning to end, which fosters confidence, boosts efficiency, and generates new opportunities.

Blockchains enable the internet to store and exchange value without needing a centralized intermediary. They are the cryptocurrency’s technological engine, the Decentralized Web, and its corollary, decentralized finance.

👉 You may be interested also in: Why you should hire a Blockchain company for your DeFi project

How to calculate ROI in Blockchain

Calculating ROI in Blockchain is totally different from how ROI is calculated in other technology or investments. This is because businesses do not readily see or quantify the Blockchain’s return of investment (ROI).

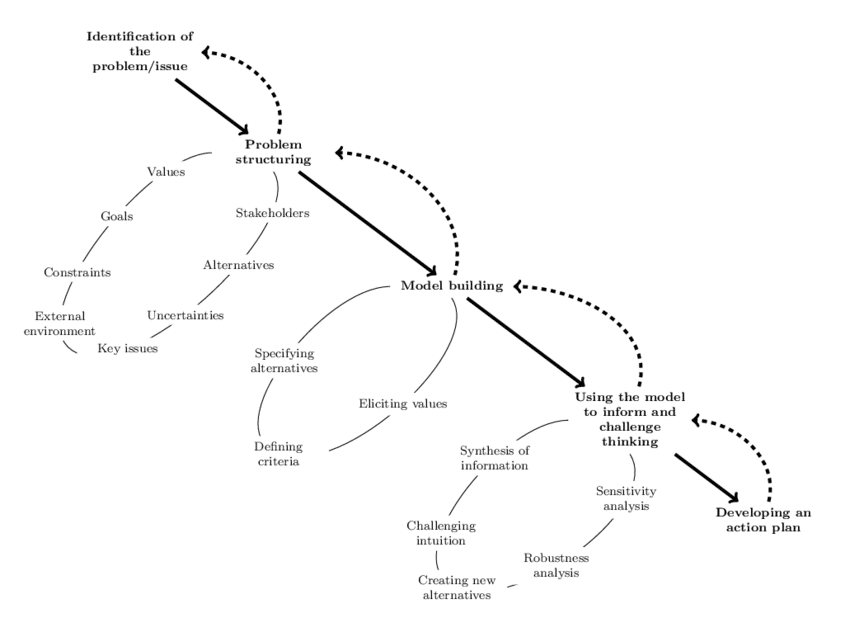

For this reason, Blockchain Business Consultants’ came to determine whether a Blockchain application is worth pursuing based on a tried-and-true decision analysis tool known as multi-criteria decision analysis (MCDA).

This means that the Consultants not only consider a variety of ROI estimates but also consider other factors that may be difficult to incorporate into ROI estimates.

MCDA is ideal for highlighting management intangibles and uncertainties that should not be buried in an ROI calculation or overlooked because they are too uncertain or difficult to quantify.

With this in mind, an ROI calculation for a Blockchain application can be performed, but it should be done as a range of values due to the large uncertainties and intangibles.

It should also be supplemented by multi-criteria decision analysis, highlighting all risks and potential benefits rather than hiding the multitude of risks and issues in a Blockchain project in a single number.

We use the words “assessing” or “analyzing” often instead of the more common “calculating” to highlight that these assessments are inherently uncertain, and we strongly advise providing a high/low range for the “likely ROI” rather than just a point estimate.

With this in mind, the rest of this article will now focus on how these assessments and analyses can be made so as to see how ROI in Blockchain can be calculated. To do this, we will see how the intangible or unseen benefits of Blockchain can be calculated as well as the impact of Blockchain technology in businesses today.

1. Calculating Blockchain ROI based on intangible benefits with multi-criteria decision analysis (MCDA)

Many people argue that intangible benefits should not be considered or calculated because they are not quantifiable or measurable. However, that should not be the case because intangible benefits can have much impact on any company or business just that they are not easily seen.

Another reason why intangible benefits should be calculated is that they can be rated as good or bad and included in multi-criteria decision analysis. And also, when these intangible benefits are ignored, they can result in making bad decisions.

Why can it result in making a bad decision? Because a company might think the implementation of Blockchain technology is not having any effect on the company, which might not be true; thereby, they may decide that they will no longer be investing in Blockchain technology.

To clarify this, let’s cite some examples of the intangible benefits of Blockchain technology in a business or company. Imagine a supply chain company that implemented Blockchain technology to help reduce counterfeit products or to help build more trust in their company.

Since they cannot easily quantify how most of their clients or customers have more trust in their company or products, they might easily think they do not see ROI on the Blockchain they implemented in their company, which is not true.

Like this example mentioned above, many businesses today are now using Blockchains to authenticate and give customers confidence that the product they order is truly organic, not counterfeit, truly fresh, and truly came from Factory X in County Y with humane worker treatment.

Increased customer satisfaction is an intangible and uncertain impact, but having the ability to check the information you can trust on a product’s origin, whether or not it was produced under the conditions you prefer, can yield tremendous benefits and increases in sales and profits.

In some Blockchain assessments, the majority of the benefits were intangible and highly uncertain but can be assessed and estimated as very reasonable and likely impacts.

So, how does multi-criteria decision analysis (MCDA) help to analyze these intangible benefits? What MCDA does is that it takes into account a variety of ROI estimates but also considers other factors that may not be easily integrated into ROI estimates.

MCDA is also excellent for highlighting intangibles and uncertainties for management that should not be concealed in an ROI calculation or overlooked because they are too uncertain or difficult to quantify.

When MCDA is applied, it helps to weigh all relevant criteria, including intangibles and difficult-to-quantify factors, that will have an effect on the success or failure of a Blockchain application. It allows you to compare dozens of applications at once in order to find the best.

Appropriate weights are applied (some factors are more important than others), and a weighted average score is computed. Unsure which factors are most important? Change the weight and see how the total weighted score changes. Examine how the various Blockchain applications perform in all relevant areas.

2. Calculating Blockchain ROI based on its impacts on businesses

Generally speaking, since the invention of Blockchain and its implementation in various businesses, it has had tremendous effects on many businesses today that have taken advantage of it.

We will list some of the ways Blockchain has significantly impacted various industries today and how this can be calculated as ROI.

✅ Ease of tracking

Blockchain and transparency are strongly intertwined. This is critical for business growth because owners are frequently unaware of the identity of vendor suppliers and the status of goods. This is critical in the perishable goods industry because they must keep meticulous records and constantly track the location of the items to avoid spoilage.

Walmart was one of the foremost major retailers to incorporate Blockchain technology into its operations. The company keeps track of where each product comes from, how it is processed and stored, and when it is the best buying time. Nestlé and Unilever have also adopted Blockchain business models.

For this reason, companies that have implemented Blockchain must have seen its impact on the company, making it so easy for them to see it as an ROI.

❌ Getting rid of the middleman

The increasing adoption of Blockchain impacts professionals working in banking, contracts, settlements, or any business process involving being a third party or middleman to a transaction.

As the keeper of trust, Blockchain technology replaces third-party intermediaries. Blockchain can help companies and individuals reduce overhead costs and hassles when trading assets by using mathematics instead of intermediaries.

The funds spent on middlemen can easily be calculated as an ROI when companies invest in Blockchain technology.

🔐 Security

Cyber Security Ventures conducted an independent analysis that found that cybercrime costs organizations upwards of $6 trillion yearly. Blockchain technology has the potential to dramatically lower this number.

Blockchain transactions are very hard to alter because no central authority solves the sector’s issue.

Blockchains store data through intricate calculations. Modern software is used by the system to find solutions to these issues and add blocks to the chain. Once the data enters the network, altering it becomes nearly difficult since it generates a novel digital imprint known as a hash.

Implementing Blockchain technology for security purposes is an obvious ROI for any company.

💰 Less expensive than conventional transactions

Businesses can now make and receive payments directly, thanks to Blockchain technology. Consequently, a third-party payment mechanism is no longer required. Companies benefit from significant transaction fee savings, which can be put toward developing new business models.

Smart contracts, which are just self-executing computer programs that do away with intermediaries like brokers, escrow agents, and other financial institutions, are used by businesses. Cryptographic codes, which are unbreakable and therefore offer maximum security, are used to enforce smart contracts.

Companies using Blockchain transactions will easily calculate their ROI based on this because they no longer spend more funds on traditional transactions.

Conclusion

One notable thing about calculating ROI in the Blockchain is that even though these cannot be easily calculated, investing in Blockchain technology can significantly affect any business or company in the long term.

The bottom line is that ROI analysis, when done correctly, can be extremely valuable as an assessment of likely costs and benefits rather than a reliable calculation of an answer.

The fact that the majority of the Fortune 500 are using or exploring Blockchain, as well as thousands of startup Blockchain businesses that have launched intending to disrupt existing businesses, is another good indicator that this new technology has great but highly uncertain potential.

Assessing the effects of new technology is inherently uncertain and necessitates estimating many intangible effects. Ignoring them in an ROI analysis is terrible advice.

See you soon,

Scaling Parrots