One of the most noteworthy developments in the global crypto markets has been decentralized finance (DeFi), which enables holders of cryptocurrencies to earn returns on their investments in the double- or triple-digit range.

However, using DeFi applications carries some risks of its own due to the prevalence of protocol hacks. More than $12 billion was lost due to DeFi attacks in 2021. This is why DeFi insurance is starting to play a more significant role in the space.

Through different sections, we will explain what decentralized finance insurance is, how it works, as well as the examples of the application of DeFi Insurance, its challenges and its benefits.

What is DeFi insurance

Decentralized finance for insurance was developed to protect investors in DeFi markets.

Like traditional insurance, decentralized insurance shields the buyer from potential financial losses that various conceivable occurrences may bring. Even as a hedge against market volatility and to secure their profits, some DeFi traders purchase insurance.

DeFi, or decentralized finance, refers to a wide range of applications that enable people to become independent of governments and other institutions like banks and insurance companies.

Smart contracts, a component of the cryptocurrency Ethereum, are the foundation of DeFi applications. These enable the connection between a computer program and a specific currency.

The main benefit of DeFi applications is that they are independent of any company and solely depend on smart contracts.

Once an application is programmed, it operates on its own. Because there is no structure to maintain, offices to rent, or intermediaries to pay, the user incurs very little cost as a result. Additionally, the registration requirements are strictly minimized. DeFi-based insurance will therefore be very affordable and adaptable in the real world.

Users must be genuinely interested in using a DeFi application and investing their ETH (Ethereum), BNB (Binance’s currency), or other cryptocurrencies for it to succeed. In a DeFi application, rules are implemented in the smart contract to achieve this goal and reward users who participate in the application in question.

Additionally, investors in the cryptocurrency associated with a particular application receive “tokens of governance” that allow them to vote on the application’s advancements.

DeFi insurance policies are valid for a specified period, and users are compensated for refundable losses that occur within the validity period.

How does DeFi insurance work

DeFi insurance is decentralized, just like the other apps. Instead of purchasing insurance from a single business or individual, DeFi participants insure themselves against one another.

DeFi insurance refers to purchasing protection against losses in DeFi incidents like hacking or a compromised private key or insuring oneself against such losses.

It is appropriate for you if you are a DeFi platform participant and have capital locked someplace on it. You run the risk of losing your money if the platform is compromised.

To shield yourself from this danger, you can visit a DeFi insurance provider and get coverage for the capital loss in the event of a specific preset occurrence.

In DeFi, you purchase insurance from a decentralized pool of coverage providers rather than from a single corporation. The events you want to cover, the type of coverage, and the length of the policy will all affect the premium you pay.

Like with regular insurance, insurance buyers need to be aware of the types of events they want to cover. Hacks on the DeFi Exchange, failed smart contracts, assaults on the DeFi protocols, and drops in the value of stable currencies are a few examples of risk-causing situations.

There are coverage providers on the other side of the table. By contributing money to the capital pool, which is then locked up, anyone, an individual, or an organization, can turn into a supplier of coverage for DeFi insurance.

You have the option to select the events or DeFi protocols for which you will offer coverage as a coverage provider. For instance, if you think there is little likelihood that a particular exchange would be compromised, you can elect to offer coverage and put the money into the capital pool.

You will be exposed to risk as a coverage supplier, earning interest on the money deposited into the capital pool.

The capital pool will be utilized to compensate harmed parties in the event that a specific exchange is compromised.

Benefits of DeFi for insurance

Now that you know how this kind of protocol operates let’s explore its benefits.

Identity checks (KYC – Know your Customer) are not required

While traditional insurance may require you to present a number of documents, including

- A comprehensive disclosure

- Personal data about you

- Numerous supplementary documents

A KYC process is unnecessary for decentralized insurance to receive protection.

Quick and automated performance

As a source of truth, more and more protocols are working directly with Blockchain oracles. In contrast to conventional services, this enables fully automatic operation without the need for a centralized third party.

Earn income from your cryptocurrencies

Additionally, as an insurer, you have the chance to earn interest on the crypto-currencies you will make available. The interests can be significant depending on the protocols and obviously measuring the associated risks due to protocols and protection services being relatively new.

Get financial protection for your cryptocurrency investments

Of course, the goal of signing up for this kind of service is to gain protection and compensation in the event of a claim. You will be qualified for partial or complete reimbursement of the losses incurred, as opposed to the typical user who will lose all of his assets.

When you consider the dangers of DeFi and the frequency of hacks, this is a significant advantage.

Costs

Fees charged for DeFi loan applications are often cheaper than those charged by banks or other institutions.

Borderless

As the applications are decentralized and not controlled by governments and banks, anyone can access the services, no matter where they are.

Examples of applications of DeFi insurance

Here are some examples of Defi Insurance providers in no particular order:

- InsurAce

A decentralized insurance protocol called InsurAce seeks to offer users of DeFi applications DeFi insurance services. It promises to shield consumers from security dangers with simple-to-use products at affordable rates.

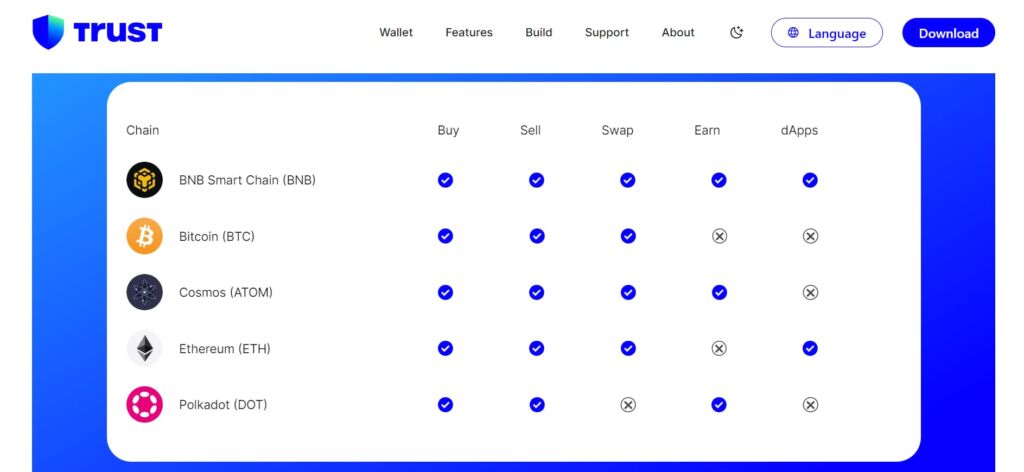

By simply connecting their wallet to the InsurAce app, anyone with a self-custody wallet like MetaMask or Trust Wallet can get insurance.

Users can insure all of their DeFi assets with InsurAce’s packaged and portfolio-based hedging options using various pricing strategies instead of doing so across several protocols and transactions. Know-your-customer (KYC) procedures are not necessary.

When smart contracts or fund custodians are violated, rug pulls, the danger of DEX initial offering events, and a stablecoin falling sharply below its pegged price are all covered by InsurAce. It works with the Polygon (MATIC), Avalanche (AVAX), Binance Smart Chain (BSC), and Ethereum (ETH) Blockchains.

- Solace

Solace is a decentralized financial insurance protocol that provides hedging policies for Aave (AAVE), Compound (COMP), Uniswap (UNI), and others. It is a risk management protocol for DeFi protocols, providing hedging and compensation for losses.

When there is a chance that a smart contract could be hacked, the protocol tries to assist liquidity providers in mitigating their risks.

Each insurance policy supplied by Solace has a single pool of cash that is used to underwrite the risks. Users who contribute money to pools make money through selling insurance and other protocol incentives.

This DeFi insurance platform accepts payments in a single transaction, requires no KYC, and instantly validates insurance claims within the Solace network. Determine the precise amount a user has lost, then reimburse them.

- Unslashed Finance

Unslashed is a decentralized insurance protocol that was introduced in January 2021 and offers protection against typical hazards for crypto assets. In order to assure ongoing collateral, it offers risk underwriters and insurance buyers nearly rapid cash.

The DeFi insurance protocol covers risks that conventional insurance would not, such as cryptocurrency exchanges and wallets, smart contract flaws, stablecoin pegs, Oracle failures, and others.

Holders of cryptocurrencies can underwrite risk by depositing funds and earning rewards, just like users of other decentralized insurance products. Currently, pooled investors can receive a 4% to 5% return on their bitcoin deposits with Unslashed.

For insurance buyers, Unslashed leverages the decentralized arbitration platform Kleros to settle protocol disagreements. Use impartial assessors and arbitrators to examine claims based on insurance policy paperwork and supporting documentation supplied by the claimant. It asserts to have a fair and open procedure to guarantee people receive the most incredible service.

- Nexus Mutual

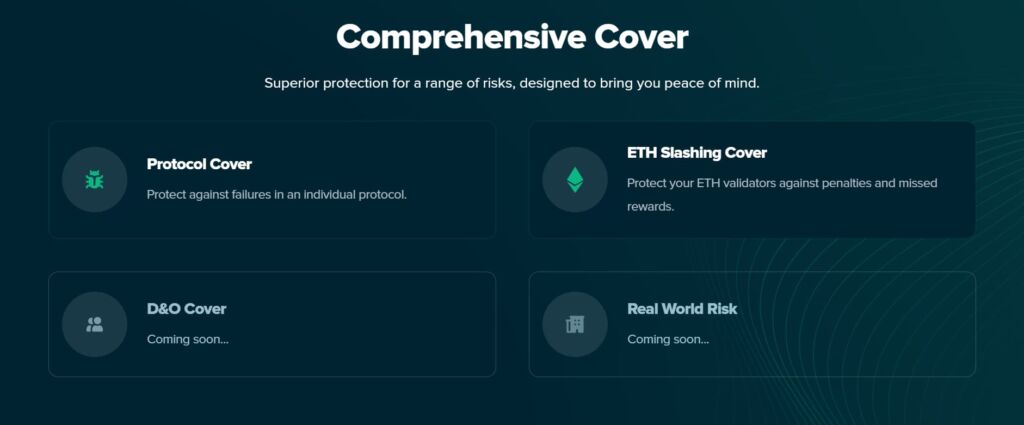

Nexus Mutual is one of the leading Defi Insurance providers, and it offers peer-to-peer insurance for major cross-chain smart contract protocols. This helps to protect against any exploits or bugs in code. Additionally, Nexus Mutual offers protection from Centrally managed Exchange hacks!

You select the protocol and quantity of coverage you desire when purchasing insurance. The amount covered may be valued for a period of 30, 90, or 365 days in either ETH or DAI. You can pay for protection using ETH or NXM, Nexus Mutual’s native governance token.

In the worst-case situation, Nexus Mutual members will judge whether your claim is legitimate if you need to file one. Sounds ominous! But claims like the bZx bug have previously been settled by Nexus Mutual in the past.

- Opium Insurance

Opium Insurance, a development of Opium Finance, is designed for DeFi traders and covers off-chain risks, price fluctuations, simple contract for future tokens (SAFT) hazards, smart contract hacks, stablecoin custodian default events, and temporary losses.

Users can choose from the various forms of insurance that are offered and buy or sell insurance as needed. Additionally, they may choose to bet money in pools and receive additional income.

Customers choose an insurance product on the platform, pay a premium to the pool, and then get a tokenized insurance position. This position has the potential to be traded on the secondary insurance market and can be employed to demand payment in the case of an insurance claim.

Challenges of DeFi for insurance

Decentralized insurance has drawbacks and risks of crypto losses, despite the fact that Blockchain technology can offer a lot of benefits to policyholders.

1. Data manipulation and contract vulnerability

The inherent risk associated with flaws in these contracts is present because everything is based on the Blockchain and generally on smart contracts. It’s entirely possible for a hacker to take control of a contract and steal money.

Additionally, because some insurance protocols rely on oracles, it is possible that some data is manipulated to obtain compensation when it should never have been necessary.

2. Capital loss in the event that insurers receive compensation

Finally, you run the risk of exposing your funds by acting as the insurer. You must be aware that the interest you earn serves to offset the risk you took. Your money will be used to pay for the damage in case of a claim.

An insurer who is exposed to decentralized insurance may consequently lose some or even all of the money invested in the liquidity pool.

3. Scams

DeFi is susceptible to scams, just like the entire cryptocurrency market. Before allocating any resources, it is necessary to research the project and those responsible in order to avoid falling into one of them. Searching for information on social media platforms, forums, newspapers, and even websites that compile court cases is worthwhile.

4. Difficulty

DeFi is still a complicated subject, which may turn off users who are unfamiliar with the cryptocurrency market. Some platforms’ usability is also not very user-friendly.

5. Volatility

Tokens on decentralized finance platforms are also incredibly volatile, just like cryptocurrencies. It is common to experience daily drops or highs above double digits, as with BTC, ETH, and other cryptocurrencies.

Conclusion

DeFi insurance products will only gain popularity as more capital shifts from conventional fixed-income products to DeFi money markets.

Although the majority of DeFi insurance protocols are still relatively small, their products may assist to stabilize the frequently unreliable DeFi market and increase investors’ comfort levels when they invest in it.

See you soon,

Scaling Parrots