Because cryptocurrencies are decentralized and not controlled by financial institutions, they require a method to verify transactions. Proof of stake is one approach that many cryptos employ (PoS). Due to concerns about the energy consumption of Proof-of-Work Blockchains, alternatives such as so-called Proof of Stake have emerged.

A system that uses this consensus mechanism works with validators that keep large amounts of the native cryptocurrency inside, allowing them to validate transactions and earn rewards.

In recent years, Proof of Stake consensus has spread significantly among public Blockchains looking to improve the execution of Bitcoin’s underlying performance. These types of Blockchains can support more applications and transactions within a given period, and groundbreaking advances have emerged in Proof of Stake to meet specific network demands.

Ethereum, the well-known smart contract platform, transitioned from Proof of Work consensus to Proof of Stake during the launch of Ethereum 2.0.

Proof of Stake also offers validators and network node operators more significant opportunities to participate in consensus compared to Proof of Work chains, such as Bitcoin. The low barrier to entry, which consists of holding a specific amount of tokens, attracts users who do not want to invest a fortune in expensive ASIC hardware for Bitcoin mining.

Proof of Stake has gained quite a bit of ground in the rapidly evolving cryptocurrency space. Its long-term sustainability among public Blockchains has yet to be proven, but it has broad support among many experts, participants, and industry observers.

In this article, we will consider Proof of stake, how it works, and the benefits and problems associated with using Proof of stake.

What is Proof Of Stake?

Proof of stake is a consensus system used to validate cryptocurrency transactions. Cryptocurrency owners may stake their coins in this system, allowing them to review new transaction blocks and add them to the Blockchain. Proof-of-stake encrypts bitcoin to safeguard the network. It uses less electricity than Bitcoin’s proof-of-work process.

Proof of Stake (PoS) is a consensus protocol created to replace the well-known Proof of Work, providing better security and scalability to the networks that implement it.

Proof of Stake is one of Blockchain technology’s two most widely used consensus protocols. The acronym PoS is derived from the name, Proof of Stake. The Proof of stake algorithm’s objective is like Proof of work, which is to create consensus among all the parties that make up the network.

Nodes that mine in Proof of Stake are called validators. The decision on which node has to validate a block is made randomly but gives greater probability to those who meet a series of criteria. Among these criteria, we can mention the amount of currency reserved and the time of participation in the network.

Once established, the node selection process starts randomly. Once the selection process is complete, the chosen nodes can validate transactions or create new blocks.

This reveals that Proof of Stake is an entirely different process from the well-known Proof of Work (PoW) protocol, where each of your nodes performs hard computing work to solve cryptographic puzzles.

This means that PoW, unlike PoS, needs large amounts of energy and specialized equipment to perform its operations. In PoS, however, this is not necessary; the process is much more straightforward and more energetically friendly. For these reasons, many Blockchain projects today are interested in this new protocol.

How does Proof Of Stake work?

The operation of the Proof of Stake protocol is quite particular. This system encourages participants to always own a certain amount of coins. The possession of coins allows them to be chosen by the random selection process to designate tasks.

Under this scheme, those with more reserves have greater weight in the network and greater opportunities to be elected. Once they are selected, they can validate transactions and be able to create new blocks within the network, allowing them to receive profits and incentives for the work done.

The proof-of-stake model allows cryptocurrency owners to stake coins and set up their own validator nodes. The act of pledging your coins to be used for transaction verification is known as staking. Your coins are inaccessible while you stake them, but you can unstake them if you want to trade them.

When a block of transactions is ready for processing, the cryptocurrency’s proof-of-stake protocol chooses a validator node to review it. The validator verifies that the transactions in the block are correct. If this is the case, they add the block to the Blockchain and receive cryptocurrency rewards for their efforts.

In short, in a Proof of Stake-based Blockchain, the weight of each validator that takes turns proposing and voting may depend, for example, on the size of their deposit (participation).

However, if a validator proposes adding a block with incorrect information, they will be penalized by losing some of their staked holdings.

The workflow of Proof of Stake is as follows:

- The Blockchain keeps a record of validators: that is, there is someone responsible for verifying transactions within a Blockchain.

- Being a validator requires having ether (the Ethereum coin).

- Validators engage in the consensus method to obtain the majority when a specific type of transaction is locked in a deposit designated by a validator.

Why was Proof Of Stake created?

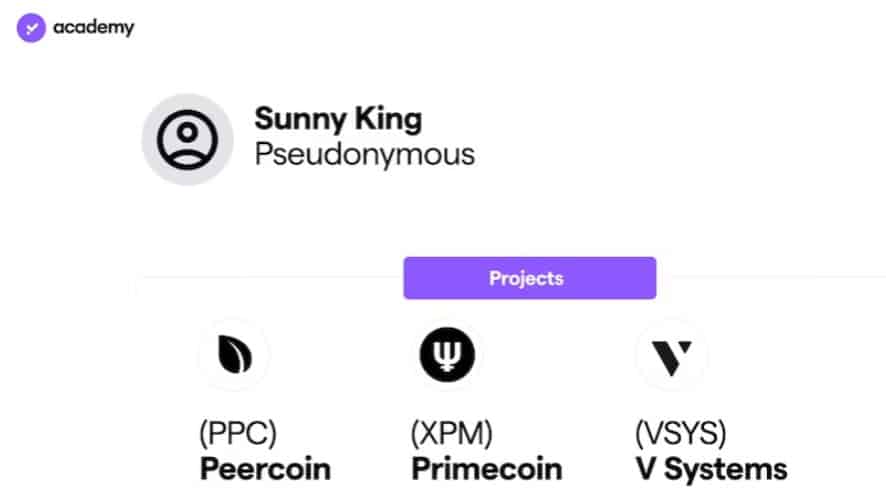

The Proof of Stake protocol was created by renowned developer Sunny King in 2011. In 2012 King formally introduced the PP Coin whitepaper, where he clarified how the Proof of Stake algorithm worked. The goal was to fix some known Proof of Work protocol issues. These include:

- Lack of scalability and speed: The mining process requires high latency to approve transactions and produce new blocks. However, Proof of Stake avoids this situation. In Blockchains that use the Proof of Stake protocol, verifications are performed by nodes with a high coin holding. This way, verifications are made quickly, positively impacting the scalability and speed of the network.

- The Proof of Work mining process requires high computing power, which usually comes from machines with high electricity consumption. But Proof of Stake radically changes this view. Change the mining process to a participatory process. Participation reflected in the holding of coins or time within the network

- The decentralization of the network: This is a problem that strongly affects Proof of Work networks today. A fact that becomes increasingly clear, especially when seeing the large mining groups, a situation that centralizes the network in the hands of a few. Proof of Stake seeks to solve this by diversifying and democratizing access to participants in the different tasks of the network.

- Subtract financial interest from attacks of 51%. 51% of attacks are one of the concurrent fears in Proof of Work networks. It is enough for a malicious mining pool to have 51% of the network’s computing power for disaster. With that capacity, the mining group can manipulate the Blockchain at will. But in a Proof of Stake system, this is only possible if the attacker owns 51% of all coins. If the attacker performs such an attack, the coin’s value tends to fall, leading to substantial economic losses for the attacker. This situation serves as a deterrent to prevent these attacks while maintaining network security.

Benefits of Proof of Stake

The Proof of Stake (PoS) protocol has a great variety and powerful features and benefits, among which we can mention:

- 🌳 It is a more environmentally friendly technology. This is attributed to the fact that it does not need powerful machines for mining activities.

- 🪫 It is not necessary to consume large amounts of electricity to secure a Blockchain, reducing its energy consumption.

- 📍 It allows a better alignment of objectives and incentives among the network members. In this way, each member of the network seeks to maintain the network for an extended period.

- ✔️ It improves decentralization and democratizes access to the network. Everyone can participate in the network if they meet their participation quota. In PoS networks, this task’s mining concepts and equipment do not apply. This avoids the concentration of power in a few hands due to how expensive their activity can be.

- 🔐 Network security is much higher. Thanks that it solves difficulties and certain schemes of attacks already known, such as the attack of 51%.

- 📈 It offers greater scalability. This is one of its main characteristics. The speed and scalability of PoS networks far exceed PoW networks. This is because it does not do intensive computational work that consumes a lot of time. This makes PoS perfect for Blockchains that want to be used as retail payment systems, where it is required to verify large numbers of transactions per second.

The problem with using Proof of Stake

PoS systems require the user’s wallet to be open and connected to the Internet. This creates a security issue allowing hackers to exploit vulnerabilities to steal funds from such wallets. There is a risk of losing funds to malicious attacks. This is one of the reasons to follow common safety criteria when using this system.

Examples of cryptocurrencies using Proof of Stake?

Most cryptocurrencies use Proof of Work, but the alternative Proof of stake has proven to be more efficient; the following are cryptocurrencies that currently use Proof of stake.

- Ethereum (ETH)

Ethereum’s current revamp includes its transition from proof-of-work consensus to proof-of-stake, which increases transaction speeds and scale-up capacity and reduces network power consumption. Therefore, you now have the option to leverage your ETH tokens to support the operation of your Blockchain. If you want to put your ETH 2.0 in participation, you can either become a validator or join a participation pool. - Tezos (WTZ)

Tezos is a multi-purpose Blockchain that uses a proof-of-stake protocol to protect your network. Token owners can delegate their accounts to other token owners, called validators, without transferring ownership of their assets. These validators will be in charge of protecting the network on your behalf. The user will then get the rewards generated minus the validator fees. - Tron (TRX)

This is another popular way to earn passive income through participation. Tron achieves a high transaction rate per second (TPS) through a delegated proof-of-stake mechanism. There are 27 validators on the Tron network that construct the blocks of your Blockchain. They are referred to as super representatives. Everyone who uses the Tron network may vote with their TRX to determine who should be an exceptional representation. You must obtain the most votes to be elected as a super representative. - Cosmos (ATOM)

It is one of the most popular participation coins. Cosmos is a unique Blockchain that feeds on its native cryptocurrency, known as ATOM. The Cosmos coin is presented as a comprehensive solution to solve the problems of scaling capacity and interoperability that the Blockchain sector has tried to solve through a hybrid proof-of-stake mechanism that relies on validators. As an ATOM owner, you can delegate your assets to vote on who should be the validator. ATOM owners choose validators, who are then rewarded for their work. You will get incentives by delegating your ATOMs to validators. It is critical to understand that the ATOMs you commission will be frozen and will not be used for any transactions. - Algorand (SOMETHING)

Algorand seeks to address the three primary difficulties that Blockchains face today: security, scalability, and decentralization. The network’s security is linked to the honesty of the majority in Algorand’s consensus mechanism, known as pure proof-of-stake. - Polkadot (DOT)

Polkadot is a next-generation Blockchain system that allows many chains to coexist on a single network. It has introduced a proof-of-stake (PoS) consensus innovation called Nominated Proof of stake (NPOS). The multi-chain protocol is intended to reclaim power by building on the revolutionary potential of existing Blockchain technology while providing several additional benefits.

Conclusion

Proof-of-stake is an alternative to proof-of-work (PoW), which Bitcoin and Ethereum currently use. Both PoS and PoW are examples of consensus mechanisms.

In conclusion, we have seen Proof of stake; a consensus algorithm that decides who validates the next block based on the number of coins being held, unlike traditional proof-of-work, in which miners solve cryptographic problems based on processing power to verify transactions.

Proof of Stake does not require powerful computers or mining equipment, so the entire network consumes much less in comparison to Proof of work.

On the other hand, some detractors consider that this model could help make the richest richer since the validation is related to the amount of coins that a participant has.

See you soon,

Scaling Parrots