In this article we will explain how the Blockchain for real estate sector works, providing you with data and concrete examples on the benefits that this technology can bring to real estate. At the end of the reading you will have a complete and clear vision of how it is possible to apply the blockchain in an area that is still not very digitized today and which has enormous growth potential in the years to come.

Whether it is the buying and selling of properties or the management of the properties themselves, real estate (an English term also widely used in Italy) is one of the most profitable and stable sectors that exist. This is further accentuated by the fact that in Italy the “brick” represents par excellence the concept of security that every citizen dreams of. This is also confirmed by Istat data, according to which 80% of Italians live in their own home.

It is therefore understandable that the real estate sector represents an incredible and “evergreen” opportunity for entrepreneurs and investors.

However, it cannot be said that the boom in the real estate market goes hand in hand with the technological one linked to it. Purchases, auctions, rentals and document management still today receive an almost analogical approach, not actually exploiting what digital has to offer.

Digital transformation is driven by data analysis, digitization of processes and services and the implementation of innovative technologies, especially Blockchain. It is precisely on the Blockchain that we want to focus. It is no coincidence that we are a Blockchain consulting and development company, and as such we have in-depth knowledge based on the work we have been carrying out since 2018.

So what are some possible applications of the Blockchain for the real estate sector? We explain them to you in this article, starting first of all from a (necessary) data analysis.

Real estate market data

A report by Scenari Immobiliare and Abitare Co. states that 50% of Italian families intend to change their residence after the pandemic. 80% of this segment of families want to switch from renting to home ownership, again for the above-mentioned concept of security.

This datum is the reflection that the real estate market is strong and long-lasting, giving hope for the trend of the next decades.

If we look at the aspect of real estate investments in Italy, we discover that the first 6 months of 2022 received almost double (+84%) of the investments compared to the last half of 2021. Most of the money in the real estate sector is allocated on offices, followed by logistics properties and hotels.

Another important area is that of real estate crowdfunding, which despite having moved to Italy much later than the rest of Europe, has recorded very strong growth, with 287 million euros raised in 2022 alone (data that emerges from the Real Estate Crowdfunding Report ad by Walliance and the Observatory of the Milan Polytechnic).

In short, the growth prospects of real estate are immense, and if associated with the growth prospects of the Blockchain sector (which forecast an average CAGR of +76% between now and 2030), they can give rise to one of the most impactful sectoral transformations of the next years.

A fundamental concept to know in the Blockchain field: possession

Before listing the 6 most relevant applications of the Blockchain for the real estate sector, it is important that you focus on one of the fundamental aspects that this technology introduces. We are talking about the concept of “possession”.

If you already know the Blockchain in principle, you will know that it represents a decentralized and immutable digital register. Every data (whether it’s a document, a photo, a video or simply a written text) recorded on this innovative technology will remain imprinted forever, without the possibility that anyone can tamper with it in any way.

This makes it possible to register the so-called “NFT“, literally “Non-Fungible-Token”. They became famous in 2021 in the artistic field, but find application in a disproportionate number of sectors, including real estate.

An owner of an NFT, which is a “unique piece” registered on the Blockchain, can be defined as the owner of a real digital asset that no one else owns, as the principle of fungibility in this type of token is lost. Whether you own an NFT that represents a painting or a fraction of an apartment, the token present in your wallet unequivocally determines that you are the owner of the token in all respects.

So here is one of the fundamental concepts of Web3: the Blockchain allows not only decentralization, but also the actual possession of a unique and irreplicable digital token (an NFT) that can represent any “real world” asset, including, of course

Read also -> Web3 and Web3: The differences

You will find out in the following paragraphs how and in which contexts NFTs can be used to radically transform one of the sectors that most need digitisation.

5 Blockchain applications for the real estate sector

Now let’s see the 5 main use cases of the Blockchain in the world of real estate.

1. Trading without intermediaries

The first major benefit of Blockchain is decentralization. Not surprisingly, this technology was born in 2009 with Bitcoin precisely with the aim of decentralizing, in the economic sphere, the power hitherto exercised by the banks.

By its nature, the Blockchain allows decentralization in any area it is applied. But what does decentralization mean in real estate? Very simple: disintermediation of the figures currently involved in the “chain” of the purchase of a property.

But let’s take a concrete example. Let’s say you want to buy a new apartment in the center of Rome. You will therefore have to find the right apartment for your needs. To do this, you can rely on a physical agency or a real estate aggregator. It doesn’t matter, in fact you will have to go through an intermediary who, only to take charge of the sale of the property, will take a commission on the total amount of the house. Once you have made the decision to buy, you will need to make the deed, which must be signed by a notary. This is an obligatory step that you will have to deal with, which provides for a commission for the aforementioned professional.

If this process took place on the Blockchain, the transfers would not have to be justified and countersigned in any way. Ergo, both the agency and the professional figure of the notary would be absolutely superfluous figures. Let me be clear, this is one of the most futuristic applications, as the figure of the notary is strictly necessary for the completion of the sale and purchase procedure. This does not mean that, in the not too distant future, it can be completely replaced by the Blockchain.

In this regard, we will see below why, thanks to Blockchain notarization, it is possible to delegate the process of registering a sale to the “block chain” technology.

1. Notarization in the real estate sector

Blockchain notarization is the process by which (in the presence of a specific digital signature and an ecosystem that certifies a certain “upstream” value) a document registered on the Blockchain is given a legal value.

If we talk about our country, it is precisely the article 8-ter of the law n. 12/2019 to define technologies on Blockchain and determine their legal effects for them. A photo registered on the Blockchain is therefore, on the basis of a law that guarantees it, a document with legal value.

The notarization could therefore also be valid in the same way from the point of view of a deed, going to completely replace the notary’s signature. But for this eventuality we will have to wait for a greater adoption of Blockchain technology.

2. Real estate tokenization

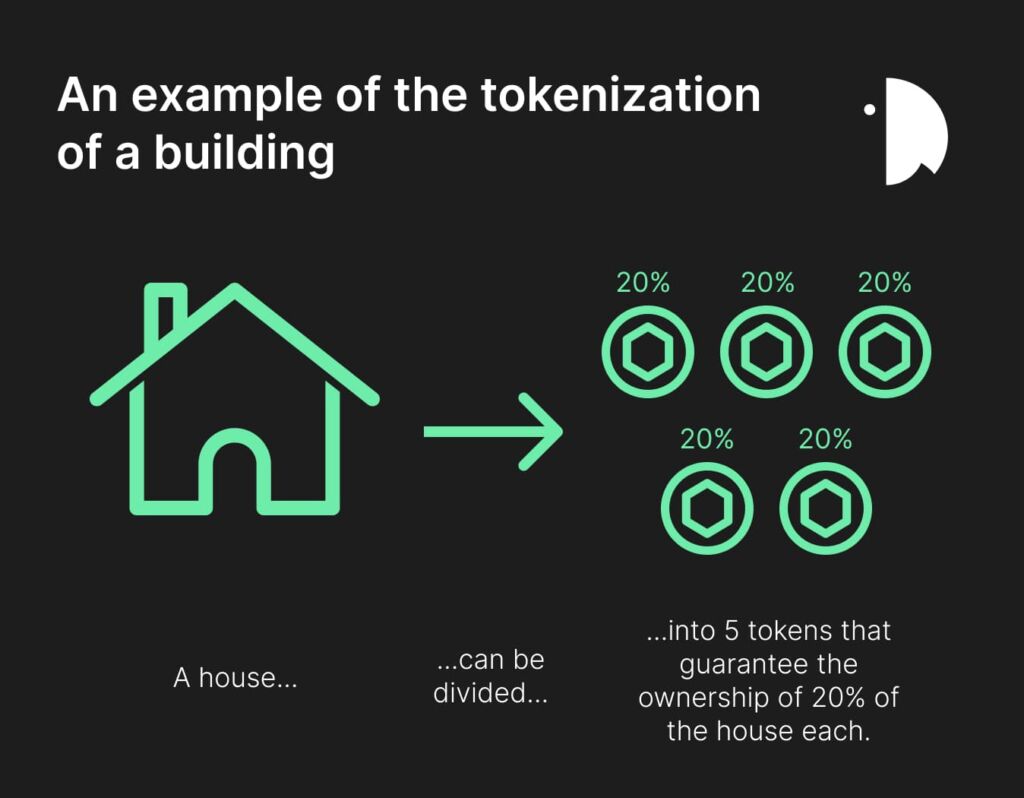

The Blockchain opens the door to opportunities that were unthinkable until recently. One of these possibilities is undoubtedly tokenization, a process in which a property is associated with one or more tokens registered on the chain. What does this mean? It actually means that any building can be “unpacked”, allowing the purchase of one or more portions of the building itself.

The real estate market is by nature not very liquid: the purchase of a property is bound by a more or less lengthy buying and selling process, and it certainly does not allow those who invest in it to be able to liquidate their investments quickly. Tokenize a property means:

- ✅ Making a market accessible to ′′ less wealthy ′′ population groups, as a fraction of a real estate clearly costs a fraction of the price of the real estate itself.

- ✅ Make the sale of your assets more liquid, as they have a lower price and can be exchanged on secondary markets directly on your computer (it is enough to have a crypto wallet).

Of course, the real estate crowdfunding market has already existed for years, allowing small and large investors to invest in fractions of properties. However, to date no company associates real estate equity with NFTs on Blockchain. This involves a greater risk than the risk associated with the investment itself, precisely due to a centralization that would not exist on the Blockchain.

Let’s try to simplify, giving you a concrete example of how tokenization can be at the service of the real estate sector.

Mrs. Rossana regularly invests in the stock market: every month she allocates a part of her liquidity to equity ETFs. However, Rossana likes to diversify and she has identified an opportunity to do so in the real estate market. At this point, she does an online search and finds a marketplace for the sale of properties under construction. These properties, sold in the form of tokens, once built are sold, generating a capital gain on the final price, which is distributed to the various investors. Rossana therefore decides to buy 10 tokens of a property under construction in Rome, which are equivalent to 0.5% of the total value of the property. She connects her crypto wallet to the marketplace, buys the 10 tokens that guarantee effective ownership of 0.5% of the property’s equity. 18 months later the property is sold, generating a capital gain which is distributed to Rossana, which can request liquidation by “burning” its own tokens for the economic consideration of the same.

If there weren’t the technological support of the Blockchain and the “unpackaging” of the properties, this process could not have existed, precluding small investors like Rossana from investing in this sector.

3. Cadastral filing

As already anticipated in the previous paragraphs, the real estate sector is obsolete not only from the point of view of the sales processes, but also (and above all) from the point of view of the public administration.

To be clear, all cadastral documents (and more generally the documentation concerning buildings) are created and stored in paper form. As you can well imagine, this determines:

- ❌ An absolutely unnecessary consumption of paper

- ❌ Document discrepancy (different digital tools to collect the same information)

- ❌ Difficulty in finding a certain document by a citizen or a municipality

It is true that for several years the public administration has been engaging in the digitization and conservation of what was previously placed on dusty shelves, but the process is still long and simple digitization is not enough.

In fact, storing any information in a database means in all respects “digitizing”, but also always in a centralized way. The Blockchain, as a decentralized tool by nature, would allow for a more efficient and democratic conservation of any cadastral data.

If the documentation is then recorded directly on-chain in SVG format, it is possible to completely avoid using external databases, which for one reason or another do not guarantee the immutability of the data (example: corrupted files, database breakage… ).

Let’s try to explain better.

On Blockchain you can register any file: a photo, a video or any document. However, since Blockchain transactions are all the more expensive (from an economic point of view) the heavier the files that are recorded within the Blockchain itself, it means that the most widespread practice is to keep the file in a “centralized” database ”. An external cloud, so to speak. Alphanumeric codes are then recorded on the block chain which correspond to a specific file on the database, avoiding unjustified economic expenditure.

All this can be remedied, precisely, thanks to super light files in SVG format, which allow you to record the documents within the chain itself, decentralizing the cadastral archiving to 100%.

To date, this archiving process has not yet taken hold, but we expect that in the not too distant future it will allow for much better management of property documentation than today.

4. Safer and more transparent real estate auctions

The judicial auction is an activity that allows you to purchase a real estate property through a public offer. In all respects, thanks to an auction it is possible to grab a house at a lower price than the market average.

The “classic” functioning of a judicial auction is very simple: after having viewed the property in question (there are also specialized online platforms) it is necessary to present the offer you wish to make in an anonymous sealed envelope. Clearly, the highest offer that reflects the minimum requirements defined in the auction wins the property, for which the purchase process then begins.

How can the Blockchain help the optimization of real estate auctions? The answer is the use of smart contracts.

If you are already familiar with smart contracts, you will know that we are talking about clauses according to which specific actions occur when certain conditions are triggered. Smart contracts are registered on the Blockchain and therefore immutable.

Suppose a smart contract is programmed in such a way that at a specific time of a day of the year (for example 3.00 pm on January 27th) the highest bid for a specific property automatically becomes the winning bid. purchase of the property itself.

Again, let’s give you a simple example. You are in a judicial auction portal and you catch your eye on an interesting apartment in the center of Padua. You are interested in its purchase, and you decide to bid to win it. Then enter the dedicated portal (a dapp that allows you to connect your crypto wallet) and make an offer of 50 ETH (currently equivalent to 64,000 euros). The offer is in fact a transaction on the Blockchain that “freezes” your offer until the end of the auction.

At the end of the auction (term defined within the smart contract computer code) the one who complies with the assignment requirements and has offered the highest amount wins the property. The money is automatically withdrawn from the bidder’s wallet, saving a great deal of time for all involved in this process.

As you may have understood, the implementation of the Blockchain in a judicial auction allows you to:

- ✅ Save time by automating manual and paper-based processes

- ✅ Make offers transparent, avoiding fraud and data manipulation

- ✅ Disintermediate the different actors of the “customer journey” from the process

5. After-sales management thanks to IoT sensors

The Blockchain, combined with IoT sensors, allows you to effectively track all the data that is generated in the use of private homes and public buildings.

One of the best examples is the gas meter: it tracks information that is generated every day through energy consumption. These data, although tracked and digitized over the years to allow remote reading, do not yet enjoy the potential of the Blockchain, which would allow:

- ✅ Storage uniformity in a single large common collector (the Blockchain, to be precise)

- ✅ Transparency in data storage, which would not be manipulated in any way

- ✅ Easy remote meter reading

In addition to the counter, any device (as long as it allows connection to an internet network) would create a perfect union with the Blockchain, offering the benefits that we have illustrated to you in the previous bulleted list.

How to ask for Blockchain advice for real estate

Now that you know what are some of the application contexts of the Blockchain for the real estate sector, book a free consultation with our software house to find out more.

Since 2018 we have been developing this technology to serve companies in any sector, including real estate. Furthermore, we currently have a real estate project underway that allows users to buy and invest in properties. It has provided us with vertical skills in the application of the Blockchain in this area.

To talk to us, simply click the button below and choose a one-hour slot. We will be happy to listen to your ideas to undertake, if necessary, a consultancy path and implement your projects.

Blockchain for Real Estate: Conclusion

As you could have understood, when we talk about Blockchain for the real estate sector we are talking about a tool with enormous potential and which offers an infinite series of benefits: the contexts of application are really many and of different nature.

The article is concluded: remember to subscribe to our newsletter to receive weekly updates on the Blockchain world.

See you soon,

Scaling parrots